The Ozempic Gap: When Weight Loss Becomes a Luxury

The holidays, from Thanksgiving to New Year's Day, have long been defined by a familiar cycle: indulgence followed by guilt, then resolution, dieting, and exercise. However, a shift is underway in how Americans approach weight management. Weight-loss drugs like Ozempic, Wegovy, and Mounjaro are showing results that far exceed traditional approaches, offering hope where diet and exercise have repeatedly fallen short.

These medications represent the most significant pharmaceutical development in obesity treatment to date

Currently, one in eight adults (12%) are taking these weight-loss drugs, and nearly one in five (18%) have used them at some point, according to KFF.

Yet their growing use reveals a paradox: the people who statistically need these drugs the most—low-income communities with the highest rates of obesity—face the greatest financial barriers to access. Adding to this challenge, these medications require ongoing use; research shows patients regain approximately two-thirds of their lost weight within one year of discontinuation, transforming what might seem like a temporary expense into a long-term financial commitment.

________________

The Bay Area's Weight Crisis

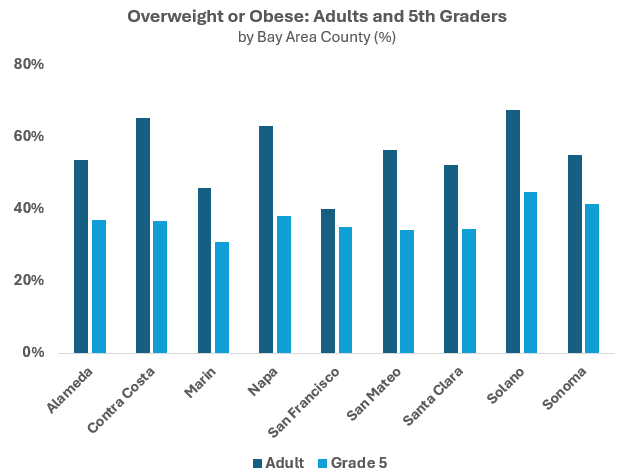

The Bay Area faces a serious and persistent weight problem. Despite the region's reputation for health consciousness and outdoor activities, the California Department of Public Health reports that more than half of Bay Area adults—55%—are overweight or obese. The problem starts early:

5th graders: 36% overweight or obese

9th graders: 32% overweight or obese

The crisis varies across counties, with the highest levels concentrated in Solano County, where 67% of adults and 45% of 5th graders are overweight or obese.

Source: California Department of Public Health

Even more concerning, there is little evidence of improvement through traditional measures. Physical activity levels tell part of the story:

Adults: 35% fall below recommended physical activity levels

Children: A staggering 81% fall below recommended physical activity levels

Sedentary lifestyles fueled by technology and persistent difficulty in sustaining dietary changes have undermined the impact of traditional weight management approaches.

This is where GLP-1 drugs like Ozempic have captured attention as a compelling new option—delivering substantial weight loss results that far exceed diet and exercise alone, even as researchers continue to evaluate long-term impacts and refine best practices.

________________

The Rise of GLP-1 Use

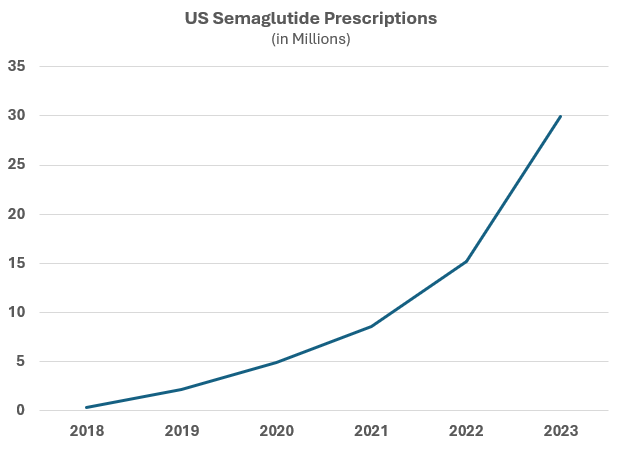

The combination of substantial weight loss results and cardiovascular benefits has driven explosive adoption. The number of prescriptions increased over 500% in the three years ending in 2023.

Source: KFF

This growth will likely continue as prices decline, newer formulations reduce side effects, and treatment strategies evolve—including microdosing approaches that use smaller doses for long-term maintenance rather than maximum weight loss.

Who's Using These Drugs?

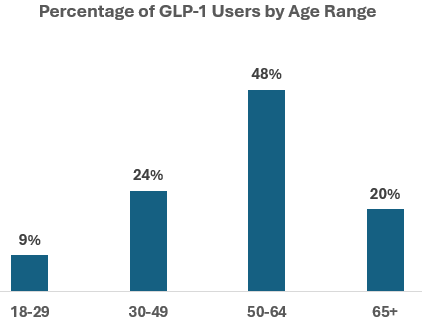

Demographic data from KFF's November 2025 polling reveals notable patterns in current usage:

Gender breakdown: Women represent 62.5% of users compared to 37.5% men.

Age concentration: Nearly 50% of users are ages 50-64. In contrast, only 9% of users are ages 18-29.

Source: KFF

This data indicates that middle-aged women (50-64) are the core GLP-1 user base, likely driven by hormonal factors and higher treatment-seeking rates, while minimal use among young adults (18-29) suggests both lower disease prevalence and persistent cost and access barriers.

________________

The Cost Barrier: Understanding the Price Gap

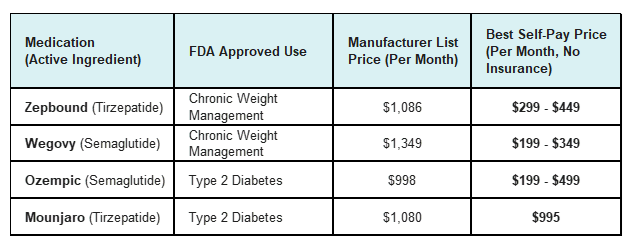

Despite their effectiveness, cost remains a significant barrier to access. The pricing structure reveals a complex landscape where manufacturer list prices tell only part of the story.

These numbers reveal several critical realities. Manufacturer list prices range from approximately $1,000 to $1,350 per month—annual costs of $12,000 to $16,000 that rival or exceed many families' entire healthcare budgets.

The "best self-pay" prices show dramatic variation—from as low as $199 to as high as $995 per month. These discounted prices come from manufacturer assistance programs, discount pharmacies, or compounding pharmacies, but availability varies significantly by location and requires navigating complex application processes. Mounjaro's self-pay price remains prohibitively high even in the best case, while Wegovy and Ozempic can be obtained for under $350 monthly through certain channels.

The Insurance Gap

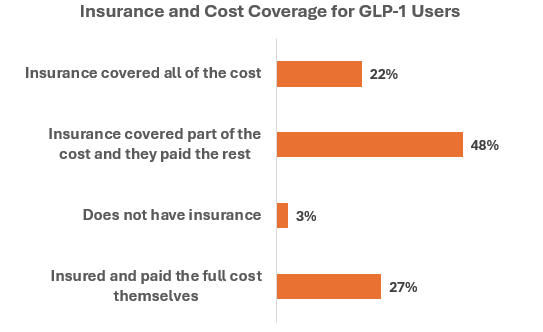

Only 22% of current users report having full insurance coverage of their drug costs, while 30% pay the full cost themselves out-of-pocket. The remainder (48%) navigates a patchwork of partial coverage and assistance programs.

Source: KFF

Many insurance plans don't cover these medications for weight loss (though they may for diabetes) or require extensive prior authorization. This creates a situation where those with resources can access the drugs, while those most in need often cannot.

These monthly costs take on added significance given that discontinuing treatment typically results in regaining the lost weight. What appears as a $200-$350 monthly expense is actually a long-term financial commitment—potentially thousands of dollars annually for years or even decades.

________________

Looking Forward

Progress is underway on multiple fronts. Newer formulations continue to reduce side effects, making the drugs more tolerable for long-term use. On December 1st, the World Health Organization recommended GLP-1 drugs for long-term obesity treatment and called for making them more affordable and accessible. This recognition as medical treatment—similar to insulin for diabetes—can drive insurance coverage and policy changes.

Multiple factors could expand access: generic competition, improved formulations with fewer side effects, bulk purchasing agreements through county health programs, and broader insurance coverage requirements.

________________

Conclusion

GLP-1 drugs like Ozempic represent a significant advancement in treating obesity and its associated cardiovascular complications. Yet a stark gap remains: while one in eight adults (12%) currently takes these drugs, 55% of Bay Area adults are overweight or obese. The 500% prescription growth over three years demonstrates demand, but long-term affordability—not just initial cost—remains the key barrier and financial challenge for many.